High Net Worth Life Insurance / / / / /

Indexed Universal Life

Indexed universal life insurance receives interest crediting based on the performance of some external index, such as the Standard & Poor's 500.

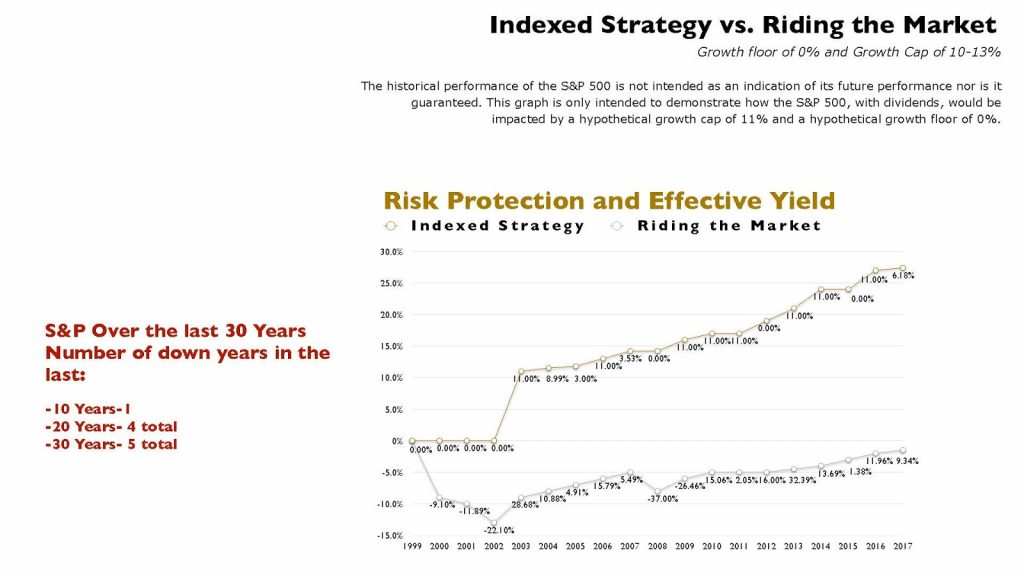

An insurer purchases options in the S&P 500 and invests a portion of your premium. These options have a 0-2 percent floor and a 10-13 percent cap.

Top 7 Benefits of Indexed Universal Life Insurance Policies

- Protection of your principal against market losses.

- Growth potential when the market is up.

- Taxed the same as life insurance.

- Tax-free access to cash values.

- Lock in positive returns.

- Adjustable death benefits with flexible premiums.

- Permanent, tax-free death benefit.

The historical performance of the S&P 500 is not intended as an indication of its future performance nor is it guaranteed. This graph is only intended to demonstrate how the S&P 500, with dividends, would be impacted by a hypothetical growth cap of 11 percent and a hypothetical growth floor of 0 percent.